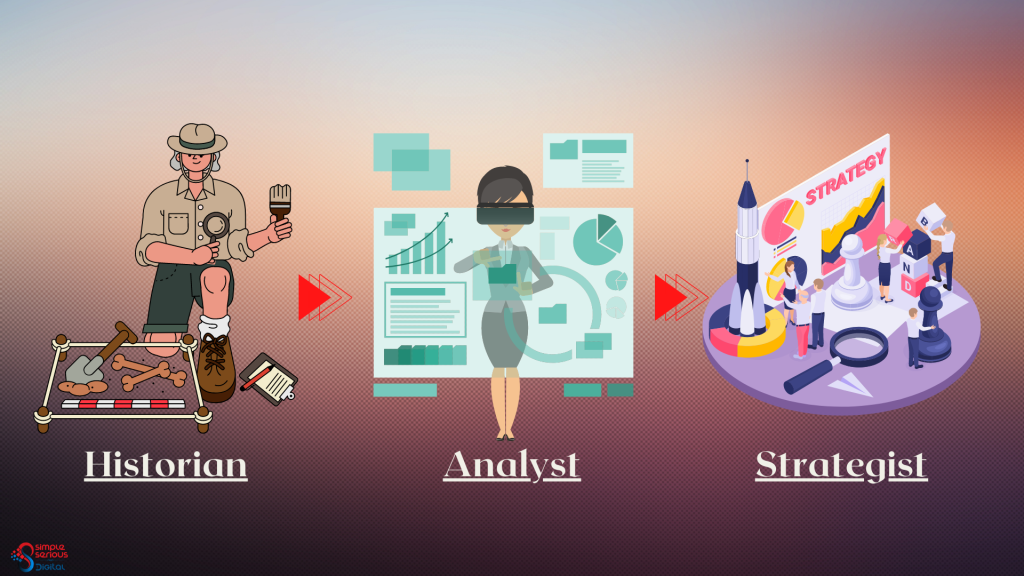

The role of finance is evolving and has shifted from a focus on record-keeping and documenting the past to a more strategic and data-driven approach. In the past, finance leaders were primarily concerned with accurately capturing financial history and using this information to make predictions about the future. However, in today’s fast-paced, real-time business environment, the role of finance leaders has evolved into that of business analyst. They use data and analytics to drive business growth and strategy and to inform decision-making.

As we look to the future, finance leaders will become even more data-driven and strategic. They will use data and even artificial intelligence to predict future business outcomes and provide the organization with the information it needs to grow. To achieve this, organizations must focus on hiring curious, creative people and developing a data-driven culture that values process, technology, and real-time data integration.

In order to become more data-driven, finance leaders must prioritize automation of financial operations. This will free up time and allow finance leaders to focus on strategic initiatives. Automation can help to eliminate manual, time-consuming processes such as compiling consolidated financials, using spreadsheets for calculations, and entering data from one system into another. By automating these processes, organizations can reduce the risk of errors and ensure that financial information is accurate, structured, and timely.

Another important aspect of being data-driven is the ability to perform multi-dimensional analysis. This requires a general ledger that can understand both GAAP and non-GAAP information and can store non-financial information in statistical accounts. This information can then be used to report on industry-specific metrics that are unique to the business. By having a general ledger that can categorize information by customer, vendor, location, department, and other dimensions, organizations can easily access the information they need to make informed decisions.

Finally, finance leaders must focus on real-time data integration with other mission-critical systems. By leveraging APIs to synchronize data in real-time, organizations can ensure that their financial information is up-to-date and accurate. This real-time data integration allows finance leaders to make informed decisions quickly and respond to business challenges in a timely manner.

In conclusion, the role of finance is evolving and becoming more strategic and data-driven. Data-driven strategies rely on a combination of technology, data analytics tools, and skilled analysts to extract meaningful insights from large volumes of data. Organizations that want to take advantage of this trend must focus on hiring curious, creative people and developing a data-driven culture that values process, technology, and real-time data integration. By automating financial operations, performing multi-dimensional analysis, and integrating data in real-time, organizations can ensure that their finance leaders have the information they need to make informed decisions and drive business growth.